GST Annual Return: GSTR-9 and GSTR-9C are Available on the portal for filing

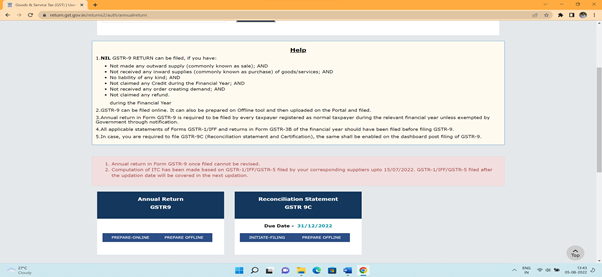

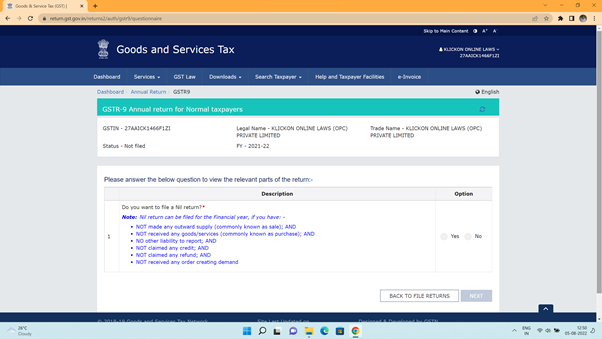

The GST annual return forms i.e. GSTR-9 and GSTR-9C are available on the portal for filing for the Financial Year 2021-22. The last date for filing the annual statement and return are 31st December 2022.

The GSTR-9 form is an annual return that has to be filed by all registered taxable persons under GST. The GSTR-9C is the GST reconciliation Statement for a particular FY on or before 31st December.

Central Board of Indirect Taxes and Customs ( CBIC ), on the recommendations of the GST Council, had issued Notification No. No. 10/2022-Central Tax dated 5thJuly, 2022 to exempt taxpayers having turnover up to 2 crores from the filing of annual returns in forms GSTR-9 and 9A. The GST Council in its 47th meeting held at Chandigarh on June, decided to exempt the small taxpayers from the compliance of annual return.