Recent changes notified for Form GSTR 3B are implemented in August 2022 GSTR 3B

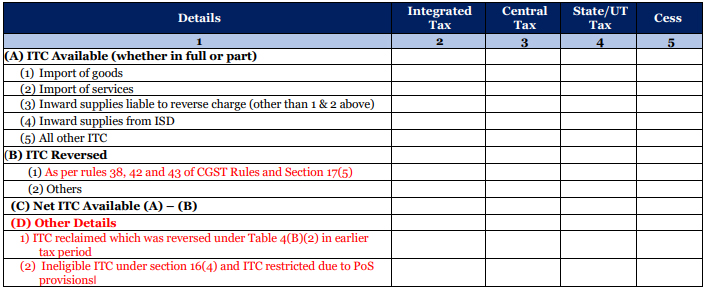

The Goods and Services Tax Network (GSTN) has made live a new Table 4 in GSTR-3B for the month of August 2022 for information on ITC correctly availed, reversal thereof and declaring ineligible ITC in Table 4 of GSTR-3B.

The Government vide Notification No. 14/2022 – Central Tax dated July 05, 2022 had notified few changes in Table 4 of Form GSTR-3B requiring taxpayers to report information on ITC correctly availed, ITC reversals as per rules 38, 42 and 43 of CGST Rules and sub-section (5) of section 17, ITC reclaimed which was reversed under Table 4(B)(2) in earlier tax period, Ineligible ITC under section 16(4) and ITC restricted due to PoS provisions in Table 4 of GSTR-3B.

These changes in reporting in Table 4 are not applicable for period prior to August- 2022 period.

From the format of Table 4, following is noteworthy:

- All non-reclaimable reversal of ITC needs to be reported in table 4(B)(1)

- All reclaimable ITC reversals may be reported in table 4(B)(2). It should be noted that ITC reversed under 4(B)(2) can be reclaimed in table 4(A)(5) at appropriate time and the break-up detail of such reclaimed ITC should be provided in 4(D)(1) in the same return.

- The ITC not-available mentioned in GSTR-2B of the taxpayer has to be reported in 4(D)(2) of table 4.

- Any ITC availed inadvertently in Table 4(A) in previous tax periods due to clerical mistakes or some other inadvertent mistake maybe reversed in Table 4(B)2.

Corresponding changes in GSTR-2B and auto-population of GSTR-3B at present are under development and the taxpayer should reflect the changes required in GSTR-3B return by way of editing the pre-filled entries so as to correctly self-assess the GSTR-3B return. These changes would be available on GST Portal in due course of time.

Taxpayers may also refer to CBIC Circular No. 170/02/2022-GST dated 06th July, 2022 for detailed clarification on reporting of ITC availment, ITC reversal and Ineligible ITC in GSTR-3B

Taxpayers are advised to report information on ITC correctly availed, ITC reversals as per rules 38, 42 and 43 of CGST Rules and sub-section (5) of section 17, ITC reclaimed which was reversed under Table 4(B)(2) in earlier tax period, Ineligible ITC under section 16(4) and ITC restricted due to PoS provisions in Table 4 of GSTR-3B for the month of August 2022 and onwards.

For the detailed advisory, please click here.