Last chance to amend invoices or claim ITC pertaining to FY 2021-22.

GSTN has opened the option to amend invoices pertaining to FY 2021-22 in Oct 2022 Return period. This has been done as per the recent amendment in CGST Act, which allows taxpayer to make amendment in invoices of last year upto 30th November of the next year.

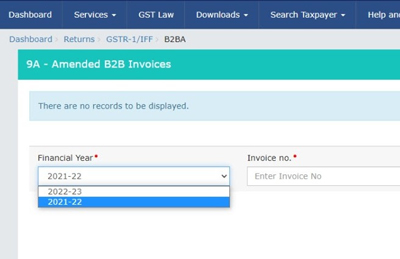

The amendment can be made via GSTR-1 -> Table 9A – > Select FY 2021-22 – > Enter Invoice No. -> Proceed

Important advisory:

It is to be noted that taxpayer is required to file either GSTR-1 for amendment in invoices issued earlier or GSTR-3B for amendment in ITC claimed earlier. Therefore it is important to make amendments before filing GSTR-1/ GSTR-3B forms for Oct 2022 period and that too well before 30.11.2022.

If a taxpayer files GSTR-1 for Oct’22 period but forget to make required amendments, then it will not be possible to make amendment later because there is no other way to make amendment before 30.11.2022.

Also, if a taxpayer waits and does not file GSTR-1 / GSTR-3B for Oct-22 period till 30.11.2022, then he will not be permitted to make amendments later.

Therefore we hereby advise not to forget to file GSTR-1 & GSTR-3B of Oct’22 period before 30.11.2022 incorporating all the amendments.